Whether one should buy a house or just rent has always been a major dilemma for people who are seeking for an abode. Search over the Internet and chances are, you would end up reading contradicting posts that would just add to your confusion- one says you should buy your own house and the other tells you it’s better to just rent. Others would even point out the convenience of renting an apartment instead.

The pandemic has somehow made it possible to buy lots and houses for less, because of the decline in market. If you are planning to buy, here are some questions you can ask or discuss with the family first, stuff you can to consider, and then decide on whether you should or should not buy a house and conversely, should rent or should not rent a house.

Table of Contents

Family

In any endeavor involving the family, planning is key. But before you lay out the plan to your dreamhouse, you need to lay out some things.Are you a young family? Are your kids adults already? How many kids do you have or how many kids do you plan to have? The answers to this questions would affect your decisions.

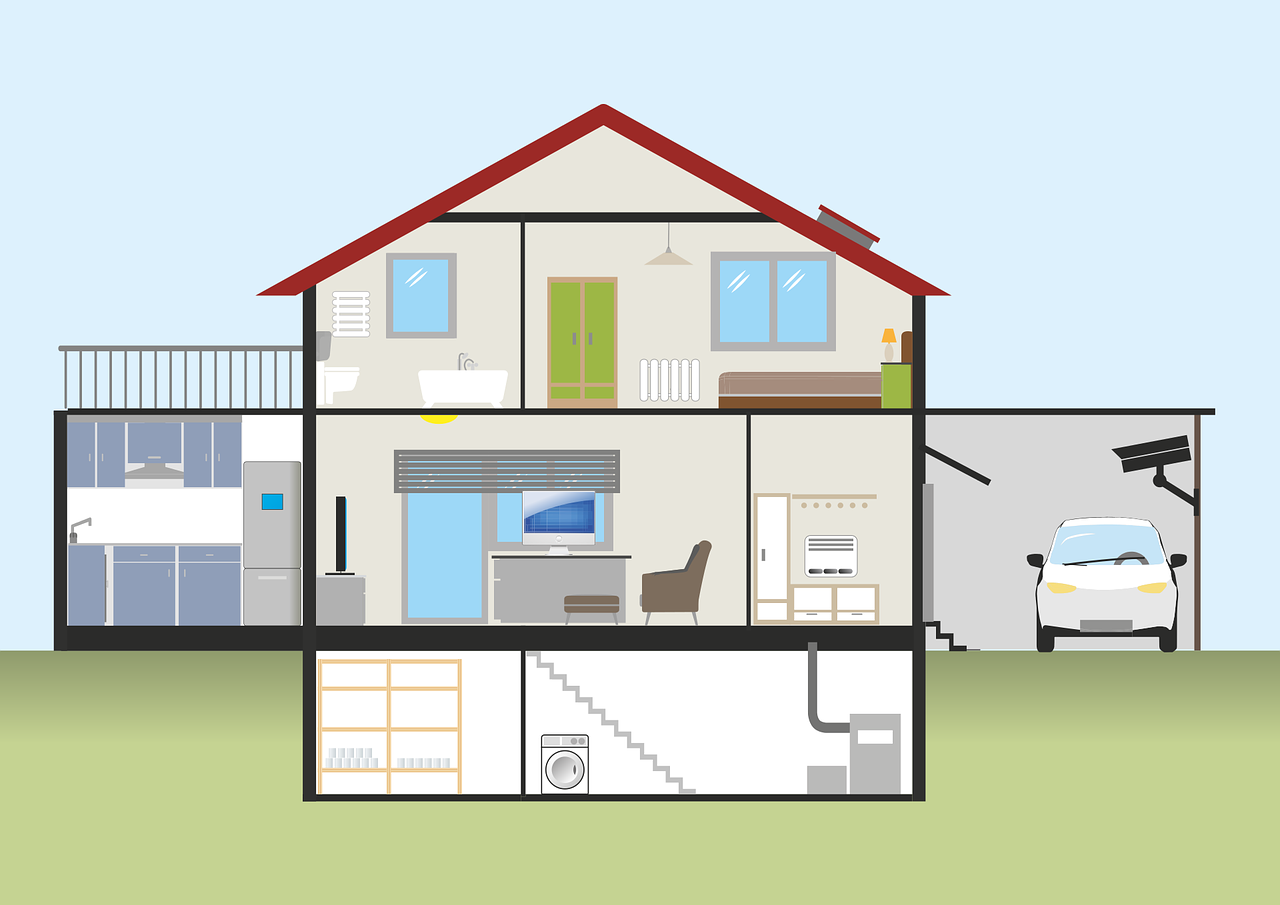

Having smaller kids mean you will spend longer years in the house with them. Bigger kids mean you would be empty nesters soon enough.Your other option is to buy a house for you and probably an extension that your kids can later inhabit.

You also need to decide to buy a refurbished house, a newly built one, start building from scratch, or maybe a manufactured house. These all have pros and cons.

Assess your financial status

You understand that your financial resources are the most important thing to consider in this buy-or-rent dilemma. If you were born with a silver spoon in your mouth, buying a house would probably as easy as 1-23- If your salary is just enough to pay your rent and other expenses, then you should immediately shun away the idea of buying a house. For now. Maybe in the next years when you see your salary on a steady rise, then you should again welcome the thought of buying your own house.

Of course, there are options when it comes to payment.You can loan out from a bank and pay the mortgage accordingly. It’s like renting but one day, you will have fully paid everything and the paying stops (sans utility fees). You can use a mortgage calculator to assess how much you would be paying for certain amount of years.

Know your capacity to pay

Different countries have different method of determining credit score.

While researching about this buy-rent dilemma, you may have encountered a question such as “What is your FICO score?” (if you are in the US) and it scared you out of your wits. But its actually pretty simple: FICO score, or the Fair Isaac Corporation score, is the score that determines your capacity to pay as an applicant for a loan. In simpler terms, it is known as credit report. Most lenders or loan companies use the FICO score to assess the financial capacity of an applicant. You could get your FICO scores for free online.

In Germany, this is called SCHUFA (Schutzgemeinschaft für allgemeine Kreditsicherung; English: General Credit Protection Agency) in Germany, as the agency but also refers to the records about credit and other related things about individuals.

Assess the nature of your job and company

Do you have a stable job? Is your company regularly laying off employees? How much do you get for compensation should you get fired from work? Will your work be viable for the long term? These are just some of the questions a person needs to ask himself/herself especially when he/she plans to buy a house. Having a stable job is crucial when you do not have a whole lot of money to pay a house upfront. Otherwise, you can rent, and save up at the same time, this may be the longer route but its doable too.

Relocate?

Houses within the city could cost double than outside or at the outskirts. Consider the commute you have to take when you buy a house that would take about an hour of travel. Does your job require you to travel frequently or perhaps even relocate? Also look into essentials that can be found within the neighborhood. Schools or kindergartens, food stores, playgrounds, potable water, are probably some you should look into. Crime rate, safety, paved roads would probably come second.

House or lot hunting could be a little too much if you do not know where to look. Thank goodness, real estate websites are easily accessible nowadays. To buy or rent a house, to buy a newly built house, or get a manufactured home can also be easy to decide on with help of real estate agents.

To Buy or Rent a House: Key Points

To buy or rent a house really depends on your financial situation among many other things. You have to consider what would be good for your family, what kind of house you would want to be living in for many years, and where would your dream house be?

You would need to discuss a number of things with the family as mentioned above. You need to assess your status: financially, emotionally, and how ready you are in putting your foot forward when it comes to the question: to buy or rent a house.

If you really want to buy one for the family or for yourself but have financial restraints, it is best to consult a real estate agent and lender.

|

|

|

it’s really hard to decide whether or not to buy a house. my parents have been hounding me on investing in a condo, but currently, at my age, i really just want to travel a bit more, taking a lot of money from my savings that i should be using for my condo. however, i still can’t forget their advise. after all, once i’m done paying the condo, at the young age of 24 years old, i’ll already have my own place to live.

It is always good to buy one but of course not everyone can afford right away, especially if you are still starting. When buying or mortgaging a house, always know your best options, know the best institution to trust your mortgage.

Thanks for sharing! 🙂

I think renting a place is much more flexible decisions especially now that there are a lot of people who invest in houses and end up working in another place.

Very informative post! Thanks for sharing.

I’m also thinking now, should I buy or rent a house? haha.

And because I don’t know where to settle down, I’m thinking to renting first. I know in the future, I’m gonna have my own house. 🙂

It is best to buy a house because it is a very good investment for yourself and family. You can actually save money if you have your own house and can do whatever you want with privacy in your home.

We bought our house and we are happy with it 🙂 Renting is not good 🙂 I’d rather buy a house and enjoy it with my family. When you rent, you are limited to do stuff in the house like improving 🙂

Getting your own and pay the monthly rent is wiser than just plainly renting one because you got to own it in the future what you have rented.

Right now, we are still renting the house we lived in, but I have a plan to buy our own house for security reason.

It’s better to buy own house when the funds are ready

but if not… it’s OK to just rent an apartment or space.